Federal Credit Union: Reputable and Safe And Secure Financial in Wyoming

Federal Credit Union: Reputable and Safe And Secure Financial in Wyoming

Blog Article

Maximize Your Financial Savings With Credit History Unions

Checking out just how cooperative credit union can aid you maximize your financial savings is a critical relocation in the direction of protecting your monetary future. The distinct benefits they supply, such as higher rates of interest and tailored financial guidance, established them aside from conventional banking institutions. By comprehending the advantages credit report unions give, you can make informed decisions to enhance your financial savings potential. So, exactly how exactly can lending institution aid you within your financial objectives and constructing a stronger economic foundation?

Benefits of Credit Report Unions for Cost Savings

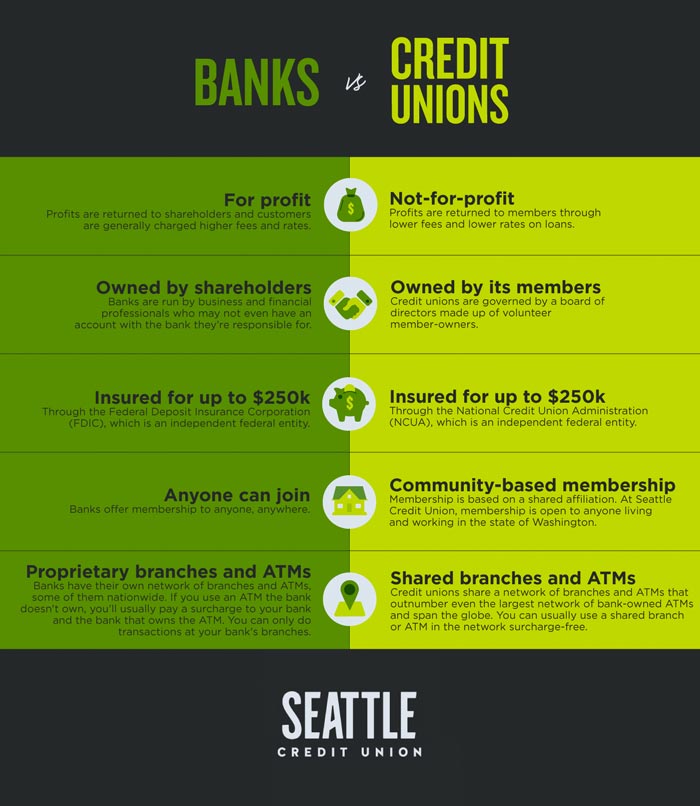

Credit history unions use a variety of benefits for people looking to optimize their financial savings capacity. Participants frequently have straight access to decision-makers and can receive customized financial suggestions to aid them accomplish their savings objectives.

One more advantage of cooperative credit union is their competitive rate of interest on interest-bearing accounts (Hybrid Line of Credit). Lending institution are recognized for using higher rate of interest rates contrasted to many financial institutions, enabling members to gain more on their cost savings over time. Furthermore, credit score unions usually have reduced costs and minimum equilibrium requirements, making it less complicated for individuals to begin saving and expand their funds without being strained by extreme charges

Moreover, cooperative credit union are community-focused monetary establishments, frequently spending back right into the communities they offer. This community-oriented technique can be attracting individuals seeking to support neighborhood campaigns and organizations while additionally growing their financial savings in a trusted and reputable establishment.

Higher Returns on Financial Savings Accounts

To make the most of returns on your financial savings, seeking economic organizations that supply higher returns on cost savings accounts is a sensible selection. Credit unions commonly supply much more competitive interest rates on savings accounts compared to traditional financial institutions.

Greater returns on interest-bearing accounts can result in a considerable distinction in the amount of interest gained in time. Even a slightly higher rate of interest can lead to obvious development in your financial savings equilibrium. This can be specifically useful for individuals looking to develop their emergency fund, conserve for a certain objective, or merely enhance their financial protection.

Lower Fees and costs

Looking for monetary organizations with lower charges and fees can further optimize your savings technique beyond simply focusing on higher returns on financial savings accounts. Credit history unions are recognized for providing reduced fees compared to typical financial institutions, making them an appealing option for individuals looking to maximize their financial savings.

In addition, lending institution usually prioritize their members' monetary health over taking full advantage of profits, resulting in less and more practical costs overall. Numerous cooperative credit union likewise use fee-free monitoring accounts and interest-bearing accounts without any monthly maintenance costs, assisting you conserve much more. When contrasting different banks, make sure to consider not just the passion prices but additionally the various fees and fees connected with their accounts - Wyoming Credit Union. Selecting a credit report union with reduced fees can dramatically affect just how much you can save in the lengthy run.

Personalized Financial Assistance

For individuals looking to enhance their monetary decision-making and accomplish their conserving objectives, accessing individualized monetary guidance is necessary. Lending institution are understood for using individualized economic advice to their participants, helping them navigate various financial scenarios and make educated selections. This customized technique collections credit rating unions apart from typical banks, where one-size-fits-all services may not address private needs successfully.

Individualized monetary guidance given by lending institution typically consists of budgeting assistance, debt management approaches, financial investment suggestions, and retirement preparation. By recognizing each member's special economic scenarios and objectives, cooperative credit union financial consultants can supply tailored recommendations to assist them maximize their financial savings and achieve long-term economic security.

In addition, lending institution focus on economic education and learning, empowering members to make sound financial decisions separately. With workshops, workshops, and individually consultations, debt unions equip their members with the understanding and skills needed to handle their funds properly. This dedication to personalized financial guidance reinforces the cooperative nature of lending institution, where members' monetary health is a website link leading priority.

Maximizing Savings Opportunities

Exploring numerous methods for making best use of financial savings can dramatically influence your monetary well-being and future security. One efficient way to optimize cost savings opportunities is by making the most of high-yield interest-bearing accounts provided by lending institution. Unlike conventional financial institutions, credit score unions are member-owned monetary institutions that commonly provide greater rates of interest on financial savings accounts, allowing your cash to grow at a quicker pace.

An additional method to consider is automating your cost savings. Establishing up automated transfers from your checking account to your interest-bearing account monthly makes sure that you constantly add to your financial savings without needing to believe regarding it. This simple yet powerful method can aid you build your savings effortlessly over time.

Verdict

To conclude, making best use of savings with lending institution provides many advantages such as higher returns on interest-bearing accounts, lower costs, and personalized economic advice. By taking advantage of these possibilities, individuals can maximize their long-lasting cost savings potential and accomplish better economic stability. Consider discovering various cost savings options offered by credit unions, such as high-yield savings accounts and certificate of down payment alternatives, to branch out cost savings why not look here methods and increase monetary growth.

To make the most of returns on your savings, seeking monetary establishments that offer greater returns on cost savings accounts is a prudent choice.Looking for economic organizations with lower fees and charges can even more optimize your cost savings technique past just focusing on greater returns on cost savings accounts. One effective way to maximize financial savings chances is by taking advantage of high-yield savings accounts provided by credit scores unions.In conclusion, making the most of savings with credit scores unions provides countless read this post here benefits such as higher returns on savings accounts, reduced costs, and customized financial support. Consider exploring different financial savings options supplied by credit rating unions, such as high-yield financial savings accounts and certificate of down payment options, to branch out savings approaches and accelerate economic growth.

Report this page